High house price drives many Chinese crazy!But where did this problem start? I don't know.But as I have felt,I think it might start at Chinese Premier Wen Jiaobao's first term.I don't know if this is true,I have to say.You know,I just think Chinese government almost did nothing in preventing the crazy rise of housing prices.

Local governments have been using real estate markets to generate revenue and thereby claim “political achievements,” they claim. Real estate developers, in turn, take advantage of loose policies to hoard properties and raise prices. Property speculators have also been driving up the value of the market.

The reason public figures have not been talking about the core problem of the real estate market is two-fold. First of all, they are benefiting from the high housing prices and do not want to acknowledge there is a problem; secondly, they want to shirk responsibility for their poor management of the housing market.

Although the central government have done lots of things to better people's life quality,it ignore the real estate market! It's the biggest problem because Housing is so important for Chinese.But the government let the bubble grow and now it's too heavy for common Chinese to shoulder.

I'm wondering if the Premier is able to solve the problem in the rest of his second term.I wish he could.Because it's a problem that is key to all Chinese.If people don't get a good response,I think it'll make Wen's image not so well in the future.

Showing posts with label price. Show all posts

Showing posts with label price. Show all posts

Wednesday, December 9, 2009

House prices rise at fastest rate for 14 months

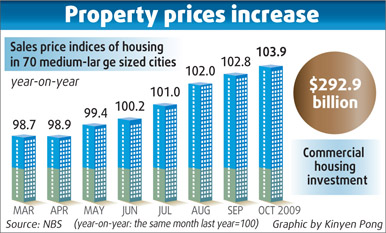

The cost of a home in China rose sharply in October, with the price surging up at its fastest rate for 14 months.

According to the National Bureau of Statistics (NBS), property prices in 70 Chinese mainland cities rose by an average of 3.9 percent when compared to their price last October.

Prices of homes in new residential buildings went up 4 percent on average in October year-on-year, while the cost of State-subsidized housing edged up by 0.6 percent. Prices of commercial residences climbed 4.4 percent and high-end housing went up by 1.5 percent.

Analysts said the rate of increase in house prices may look high but that was because the property market in October 2008 was at the lowest point it reached during the downturn and the bar was set very low.

"If you put the number into a month-on-month perspective, there is much less price fluctuation," said Chen Sheng, a director with China Index Academy.

According to the NBS, the average cost of housing in October crept up by just 0.7 percent compared to the price in September.

"Average homebuyers might be misled by the higher rates of increase in the few major cities, such as Guangzhou, Beijing and Shanghai," Chen explained.

Nationwide, the price of new homes rose in 62 cities in October compared to a year earlier. Guangzhou reported the biggest rise - 12.1 percent - followed by Jinhua, Zhejiang province, which jumped by 11 percent.

While price rises were common in many cities, some were becoming more affordable.

In Jilin city, the cost of a home fell by 4.9 percent. In Xuzhou, Jiangsu province, properties fetched 3.7 percent less.

Experts say property prices - especially in Shanghai - could continue to go up at a fast rate during the next few months because of a buying spree triggered by talk of the possible removal of the favorable mortgage policy.

Fang's observation was taken seriously by many would-be homebuyers.

Thirty-year-old Luo Yan and her husband raced to complete the purchase of a three-bedroom apartment in Shanghai with the help of an 800,000 yuan ($117,000) mortgage. The amount they borrowed was the maximum they qualified for.

"I am afraid that if we don't do something now, we will certainly miss the boat," Luo said.

Joe Zhou, research head at property consultants Jones Lang LaSalle, said in the following months, "we expect house prices will remain at a high level, bolstered by increasingly strong demand and limited supply."

Subscribe to:

Posts (Atom)